is idaho tax friendly to retirees

This guide lists some resources that can be useful to Idaho senior citizens and retirees. 404-417-6501 or 877-423-6177 or dorgeorgiagovtaxes.

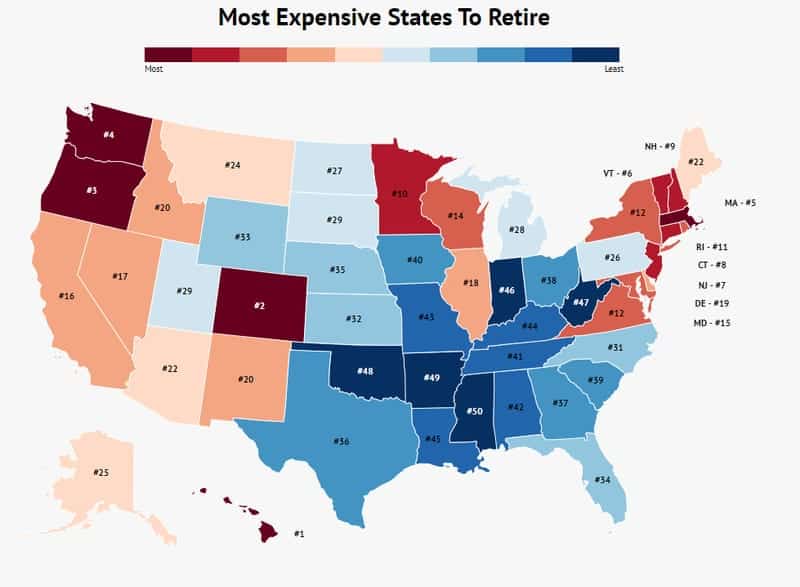

The 10 Most Expensive States To Retire And The Least Expensive Zippia

How All 50 States Tax Retirees.

. Youre married to a service member whos serving in Idaho and has registered in the military with another state as a home of record. Retrieved November 23. The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income.

An individual who is recognized as disabled by the Social. Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Employer funded pension plans exempt these self-funded plans may be fully or partly taxable.

The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old. New Look At Your Financial Strategy. Taxes are inevitable in some form no matter if you are a civilian or military retiree or wherever you may live.

If you have a 500000 portfolio be prepared to have enough income for your retirement. Visit The Official Edward Jones Site. Use the instructions for.

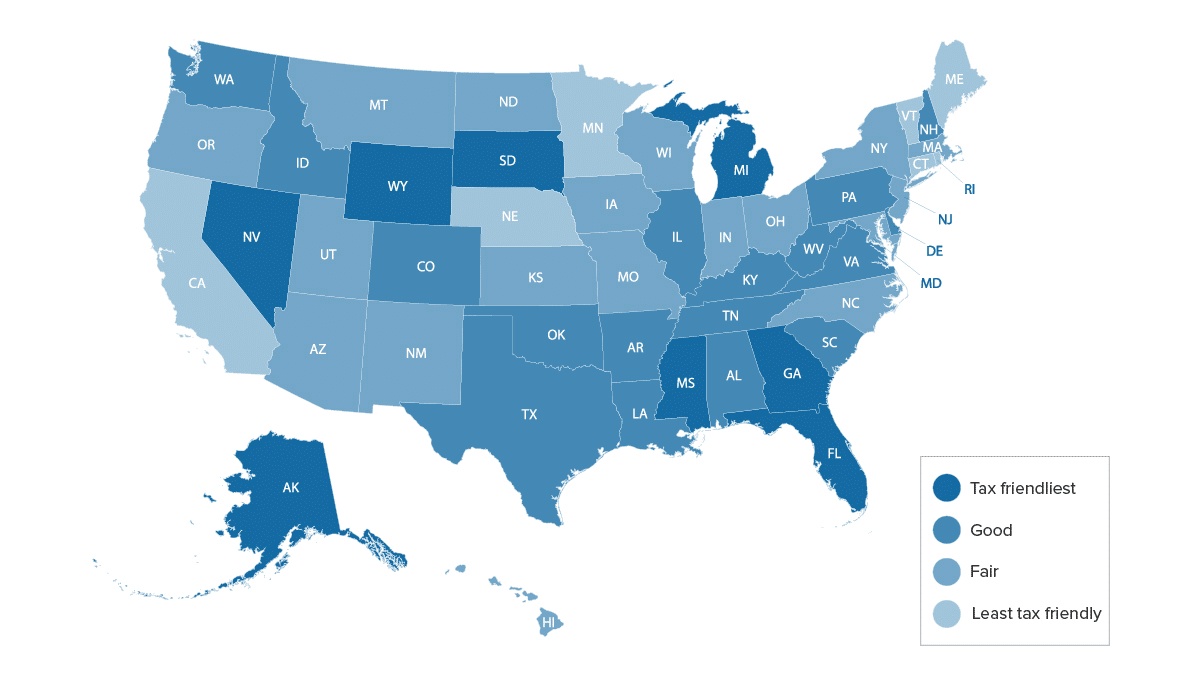

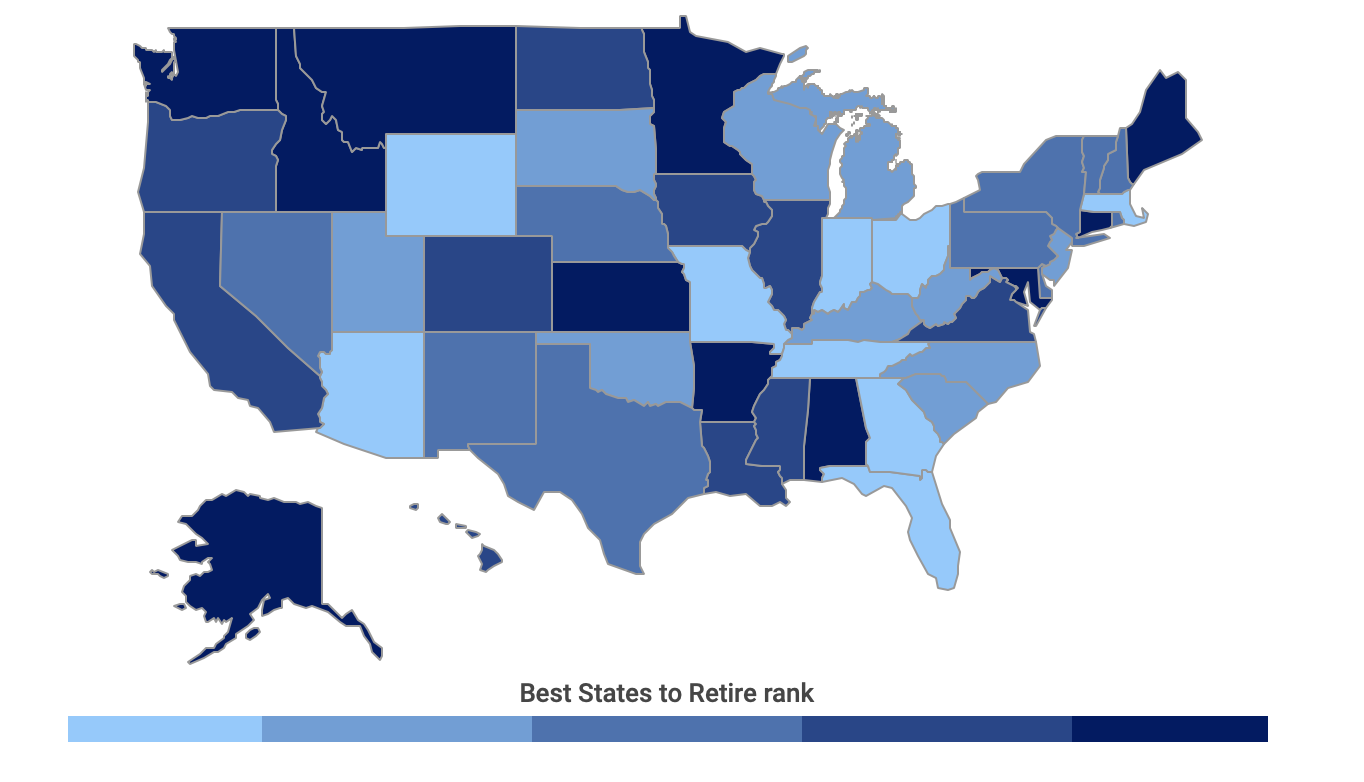

Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least tax-friendly states for retirees. Idaho Relative tax burden. Part-year residents must pay tax on all income they receive while living in Idaho plus any income they receive from Idaho sources while living outside of Idaho.

As a service members spouse you may qualify for the federal Military Spouses Residency Relief Act SR 475 HR 1182 which was passed in November 2009. This is why if you are a retiree with a fixed income you might prefer tax-friendly states. Use this guide to get help determining which states are tax-friendly for retirees.

State sales and average local tax. But income tax is the 4th highest on the list. 800-352-3671 or 850-488-6800 or.

Retirement income exclusion from 35000 to 65000. To determine the top 25 tax-friendly state for retirees GOBankingRates examined data from the Tax Foundation on each states 1. Idaho Property Tax Breaks for Retirees For 2022 homeowners age 65 or older with income of 32230 or less are eligible for a property tax reduction of up to 1500.

Ad Download The 15-Minute Retirement Plan by Fisher Investments. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Idaho is tax-friendly toward retirees.

Kiplinger calls it the least-tax-friendly state for retirees. Part 1 Age Disability and Filing status. The Act exempts you from paying income tax if.

Recipients must be at least age 65 or be classified as disabled and at least age 62. Fairly tax-friendly but residents pay full tax on private retirement plans. Idaho considers the following individuals to be disabled.

Retirees benefit from a relatively low property tax and no tax on Social Security income in Idaho. Idaho residents must pay tax on their total income including income earned in another state or country. Depending on where you live when you retire you may have to pay all of these taxes or just a few.

Like saying which are the best states for military retirees the same goes for. Social Security income tax breaks if AGI is 4300058000 or less. In a state like Wyoming which has no income tax along with low sales and property taxes retirees can expect to have a very small tax bill.

On the other hand taxes in a state like Nebraska which taxes all retirement income and has high property tax rates the overall state and local tax bill for a senior could be thousands of dollars higher. Retiree-friendly plus a low tax burden Pros No sales tax No estate or inheritance tax Average property tax 604 per 100000 of assessed value 2 Social Security benefits exempt Seniors 60 and older can exempt 12500 of qualified pension and investment income In the Middle Homeowners.

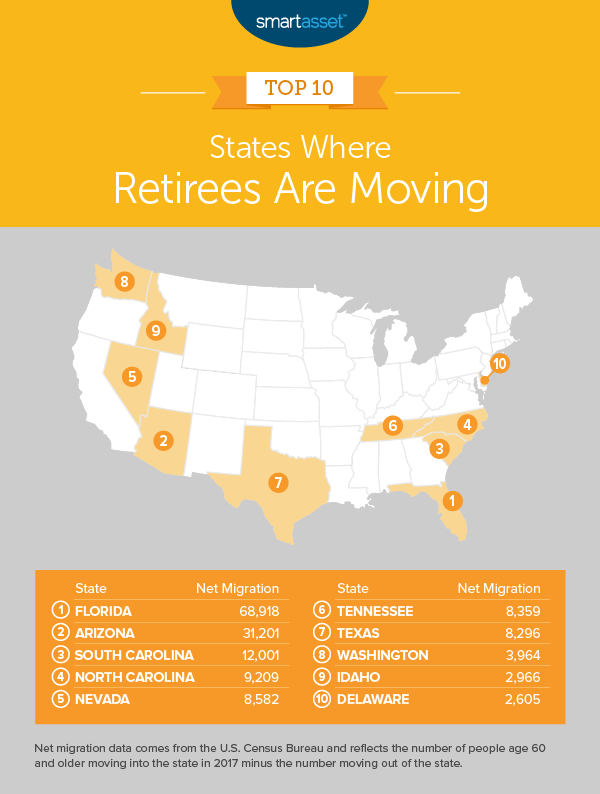

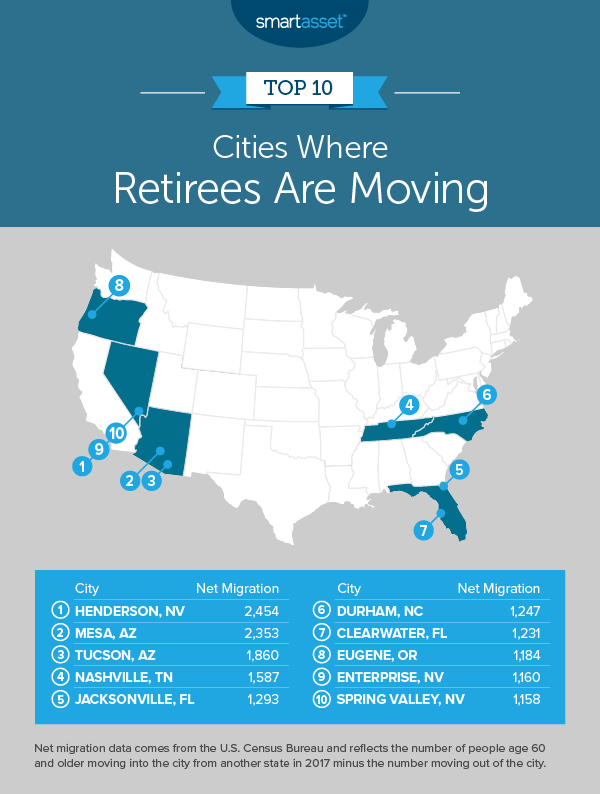

Where Retirees Are Moving 2019 Edition Smartasset

Most Tax Friendly States For Retirees Ranked Goodlife

Retirees Aren T Moving To Idaho For Its Taxes Idaho Business Review

Idaho Retirement Tax Friendliness Smartasset

State By State Guide To Taxes On Retirees Otosection

Map Here Are The Best And Worst U S States For Retirement In 2020

Idaho Retirement Taxes And Economic Factors To Consider

West Virginia Is Third Best State For Retirement Survey Says Wowk 13 News

Most Tax Friendly States For Retirees Ranked Goodlife

Idaho Retirement Tax Friendliness Smartasset

2021 S Best And Worst States For Retirement News Mcknight S Senior Living

Where Retirees Are Moving 2019 Edition Smartasset

Best Worst States To Retire In 2022 Guide

The 10 Best States For Retirement Meld Financial

7 States That Do Not Tax Retirement Income

Most Tax Friendly States For Retirees Ranked Goodlife